15 Tips for Improving Your Inventory Control

For some, the term “inventory control” may seem more like an oxymoron than a management practice. If you feel like your inventory is anything but controllable, here are 15 tips to help you better manage the process, thereby creating added success and profitability for your fleet.

Tip 1: Implement and Enforce an Inventory Control System

Every parts operation needs an inventory control system of some sort, which should incorporate the following key elements:

• It must warn parts personnel far in advance that a part is being depleted from stock.

• It must list a part’s historical purchase price so that if the price changes, the

manager will be able look into the issue and ascertain whether this change is a price increase or due to incorrect billing.

• It should list vendors that offer the best prices.

• It should give past usage rates so that the manager can determine proper inventory

levels.

• It should require as little writing as possible, particularly by mechanics.

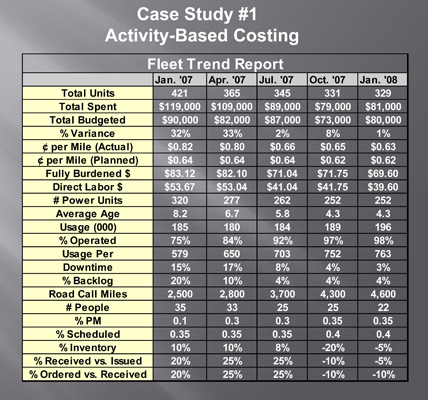

Tip 2: Know Your True Total Demand

Total demand is a complete record of all filled orders and actual parts delivered to customers regardless of the source. In addition to filled orders, a complete and total record of all lost sales – those sales that never occurred due to lack of inventory – must be kept.

A total demand record helps to reveal the changing and flexible nature of the marketplace and aids you in stocking the right parts in the right quantities at the right time.

Tip 3: Define Your Economic Order Quantity

The economic order quantity equation helps define the optimum inventory order amounts by factoring in the cost and demand of that inventory. Your goal should be to make as few orders as possible while also maintaining the proper inventory.

The cost of writing a purchase order and of paying the bill varies between approximately $35 and $50 per transaction. Considering this high cost, a target minimum of $500 of inventory per month should be purchased from each vendor. Placing an order for a smaller amount of merchandise creates a disproportionate and uneconomical clerical expense. If only a small amount of stock is ordered each month, good prices for those items will not offset the cost of paperwork.

Tip 4: Reduce Your Carrying Costs

The carrying costs of inventory can be between 30 and 40 percent of the total inventory value. You should have an ongoing strategy for reducing the costs of:

• Rent or proportionate building depreciation; building maintenance and repair; utilities; and labor costs for janitorial staff and security guards.

• Inventory storage and material-handling equipment.

• Taxes.

• Insurance.

• Inventory personnel salary and benefits.

• Damaged and nonreturnable parts, pilferage, warranty claim time and returning parts.

• Lack of return on inventory and control investments that might otherwise produce income.

Tip 5: Establish a Formal Warranty Program

Each premature component failure due to a supplier vendor providing poor workmanship, poor materials, and/or any latent defects should be flagged by fleet management and inspected by the vendor. Once inspected, the vendor can make a decision about the fleet’s claims about the component. The vendor should provide a monthly inspection that includes an agreed-upon settlement and a credit to the fleet. These parts failures have costs, and it is important that you set your ceiling for recovery at 5 percent of the dollars spent with that vendor. Should reclamation be more than 5 percent, begin exploring alternative vendor solutions.

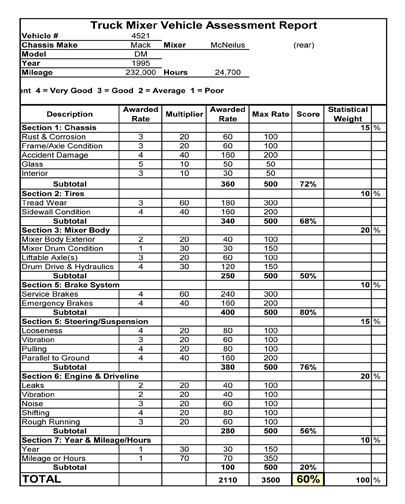

Tip 6: Start with Big-Ticket Inventory Items

In evaluating big-ticket items or items with an aggregate targeted shelf inventory value of at least $5,000, limit your inventory to the amount needed for a 90-day period. If these items can be purchased locally within one or two days, it may not be necessary to stock them at all, especially if the repair requires one or several days of preparation work before the part is needed.

Make sure you weigh the cost of keeping big-ticket items in stock against the cost of customer out-of-service times. You may find that limited out-of-service times are more economically sound than maintaining inventory of relatively expensive items.

Tip 7: Invest in Your Brain Power

If a large inventory is your only solution to create a high level of vehicle availability, you will be hard-pressed to find ways to reduce inventory costs. The reality is that you must be consistently vigilant at keeping your inventory as lean as possible. The more you learn about the parts inventory business model, best principles and practices, successful analysis and applied corrective strategies, the better you will be at effectively planning a successful inventory strategy.

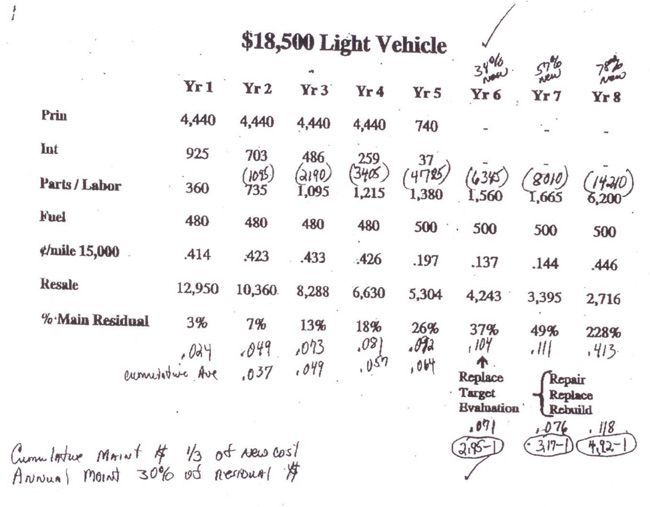

Tip 8: Don’t Confuse Price with Cost

Too often, price and cost are used interchangeably and in error. Price is what you pay in dollars to acquire a product or service. Cost takes into consideration all the factors that add up to return on investment. Ease of installation, frequency of service, labor required and safety are only a few of the considerations in determining cost. In essence, if you are to justify the high initial price of a product, you will have to do so based on cost. Make sure you analyze and understand all of the costs of your operations prior to beginning any inventory strategy.

Tip 9: Require Vendor Guarantee of On-Time Delivery

Don’t resort to expensive stockpiling of key materials in order to avoid inventory shortfalls

caused by late delivery of parts by suppliers. Instead, put the burden of responsibility for

prompt delivery on suppliers – where it belongs. One way to do this is to guarantee the vendor a minimum monthly purchase in exchange for the vendor promising both on-time delivery as well as a penalty payment if you have to purchase materials on the spot market to fill a gap when a delivery is late. The penalty payment should be equal to the cost you expended to obtain the materials.

Tip 10: Negotiate, Negotiate, Negotiate

When mounting an effort against waste in inventory handling, a manager should first consider the company’s purchasing policies and past experience with parts suppliers. Are the prices the lowest possible? If lower prices can be negotiated elsewhere based on volume, will service and delivery remain acceptable? It is futile to negotiate with no idea of realistic costs or possible price reductions. Therefore, purchasing guidelines must be established early in negotiations by someone familiar with parts-pricing discounts.

Tip 11: Brand Loyalty Doesn’t Pay

Negotiations should not be brought to a standstill by a fleet manager’s insistence on one

and only one brand of a part. In virtually every area, there are competitive lines available. This

can be a negotiation advantage. For example, if one line is not available at a jobber price – which is usually between the MSRP and warehouse distributor price – perhaps a competitive brand would be. Flexibility in this aspect can be profitable.

Tip 12: Don’t Overlook the Small-Ticket Items

Bolts, nuts and other similarly sized shop supplies constitute an often-neglected expense that can be significantly reduced. A common mistake on the part of managers is thinking that nuts and bolts are small-ticket items. In fact, such supplies will generally account for around 8 percent of the total parts bill each month. Much of this expense is waste attributable to poor purchasing habits. For instance, if you purchase these expendables from a salesperson who offers free bolt bins and other inducements to buy, you might be paying two to five times more than you should for these supplies. Even though they may be easy to overlook, it’s important to be aware of the cost of these materials.

Tip 13: Do Your Pricing Homework

If you don’t have an ongoing method for checking parts prices, you’ll have a hard time creating inventory efficiency. You should always have the latest price sheets from all the vendors with whom you do business.

As merchandise is received and volume changes, the prices on several items should be spot-checked to make certain the proper discounts are in effect. Without this monitoring, you will miss pricing and discount mistakes made by the vendor. To reduce any confusion over agreed-upon pricing, deal with one designated representative from each vendor whenever possible.

Tip 14: Plan Ahead for Hard-to-Get Parts

Availability of hard-to-get parts can obviously present problems, but longer delivery times shouldn’t necessarily preclude the use of a particular vendor. For instance, a part might be available locally at a cost of 20 percent greater than an out-of-town vendor would charge. If the part is ordered from the local vendor, delivery would require only a few days while the other supplier would need two weeks to deliver the part. However, given the substantial cost savings, it would be better to use the out-of-town vendor and simply stock an extra two weeks’ supply of the part.

Tip 15: Keep the Old Inventory Cycle Going

Simply put, old inventory needs to be removed from the parts room. A formal inventory should be taken every six months. Items that have not been used in those six months should be taken off the shelves, assuming that a system of cycle counting – frequent, random sampling of inventory line items – is not being used.

About the Author: John Dolce is a fleet facility and maintenance specialist employed by Wendel Companies, an architectural and engineering firm. He is an active consultant, instructor and fleet manager with more than 40 years of experience in the public and private sectors. Dolce has written three fleet-related textbooks and teaches fleet management courses at the University of Wisconsin’s Milwaukee and Madison campuses. He can be contacted at johnedolce@yahoo.com.