The Latest Developments in Self-Sealing Tires

For utility fleets, being able to travel across hazardous terrain – such as storm-impacted areas covered in branches, glass and other debris – is a must. Self-sealing tires can be a great asset during these times, allowing vehicle operators to continue driving even after a tire is punctured.

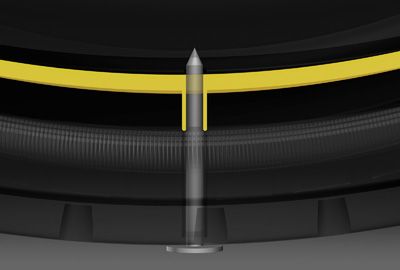

How do self-sealing tires work? Each tire contains an extra layer comprised of a sticky substance that covers the inside of the tire from one shoulder to the other. As a puncture occurs, the substance automatically seals the hole, staving off a flat tire. For instance, DuraSeal Technology developed by The Goodyear Tire & Rubber Co. (www.goodyear.com) seals punctures up to a quarter-inch in diameter in the repairable area of the tread. And as long as the sidewalls aren’t punctured, drivers can continue operating their vehicles indefinitely. In cases where tire repair or replacement is necessary, self-sealing technology gives drivers time to navigate to a safe place where the work can be done.

Overall, self-sealing tires offer both safety and response-time benefits to utility fleets, helping to ensure that crews can reach isolated areas to restore power to customers without worrying as much about getting a flat tire and the additional man hours such a situation can require.

Fleet-Specific Tires

Many manufacturers are developing self-sealing tire technology. But while companies like Michelin and Continental Tire are focused on developing the technology for light-duty and privately owned vehicles, Goodyear’s DuraSeal self-sealing tire line has been created especially for truck fleets.

“Utility fleet trucks often travel across challenging, debris-strewn surfaces en route to their destinations and are sometimes exposed to objects that have the potential to puncture their tires, which can result in vehicle downtime, an expensive proposition for utility companies,” said Norberto Flores, marketing manager at Goodyear. “Goodyear DuraSeal Technology is designed to help minimize downtime by allowing truck tires to retain air pressure and continue rolling.”

Flores explained that once built into the tire’s casing, Goodyear DuraSeal Technology remains there through the tire’s life cycle – including multiple retreads – and continues to offer downtime-minimizing benefits throughout that life cycle. A wide range of tires that contain Goodyear’s DuraSeal Technology are currently available in the U.S. In particular, the company offers the G731 MSA and G751 MSA specifically for mixed-service and utility trucks. The G731 MSA is designed for 20 percent on-road and 80-percent off-road applications, while the G751 MSA is designed for 80 percent on-road and 20 percent off-road applications.

“The G751 MSA contains more wearable volume for extra miles to removal; a special tread compound for enhanced resistance to cuts, chips and tears; lower rolling resistance construction for improved fuel efficiency; a wide footprint for optimal traction and stability; and a sturdy, tough casing for retreading,” Flores said. Likewise, the G731 MSA offers enhanced tread life, retreadability and fuel economy, he added.

The seemingly steep price tag is one of the primary prohibitive factors when utilities are deciding whether or not to incorporate self-sealing tires into their fleets. But while these types of tires currently cost about three times as much as a standard tire, they will eventually pay for themselves over time through decreased vehicle downtime and fewer tire replacements. The question fleet managers must ask themselves is whether the extra cost is worth the extended time a tire can be used in the field before a replacement is needed.

About the Author: Cheryl Knight has written for the fleet industry for more than 20 years. Her work has appeared in Automotive Fleet, Fleet Financials, Government Fleet and a number of other niche-market publications.

*****

Tire Facts

- There are nearly 11,000 tire-related crashes per year in the U.S., with almost 200 fatalities.

- Underinflated tires lower gas mileage by 0.3 percent for every 1 pound-per-square-inch drop in pressure.

- Proper inflation can extend the life of tires by up to 4,700 miles.

Source: National Highway Traffic Safety Administration at www.safercar.gov